Quick Cash Money within your reaches: Discover the Perks of Online Loans

Seeking a practical and also fast method to get cash in a pinch? Look no more! With online lendings, you can have fast money right at your fingertips. Bid farewell to extensive application procedures and hey there to a streamlined experience. Get approved and also moneyed in no time at all, with flexible repayment alternatives that fit your needs. And also, appreciate the comfort of accessing funds anytime, anywhere. Don't miss out on out on the competitive interest prices and also terms readily available. It's time to find the benefits of on the internet fundings.

Streamlined Application Process

You'll enjoy exactly how very easy it is to request an on the internet lending with a structured application process. Gone are the days of extensive paperwork as well as endless lines at the bank. With online finances, you can apply from the comfort of your very own home, any time that suits you. The application procedure is developed to be straightforward and easy, allowing you to complete it within minutes. All you require is a steady web connection and a couple of basic papers.

To begin, you'll see the lending institution's website and also load out an on-line application type. When you have actually completed the form, you'll submit it online, and also the loan provider will begin reviewing your application.

Unlike typical car loans, online car loans do not need extensive paperwork or in-person gos to. If your application is accepted, the funds will be transferred directly right into your financial institution account, ready for you to make use of.

Obtaining an on the internet finance with a structured application procedure is a hassle-free method to obtain the monetary aid you need. Why wait? Begin your application today and experience the simplicity and comfort of on-line financing.

Quick Authorization and Funding

When it comes to quick approval and funding, online financings have got you covered. Unlike standard financial institutions, on the internet lending institutions comprehend the seriousness of your monetary requirements as well as aim to supply a smooth experience.

When you submit your application, the online borrowing system will review your details without delay. Within minutes, you will certainly get a decision on your loan application.

Upon authorization, the funds will be transferred straight into your checking account. On the internet lenders focus on speed, so you can anticipate to get the funds within 1 day. This indicates you can address your economic emergencies right away.

The benefit of online borrowing prolongs past the quick authorization as well as financing process. You can access these solutions from the comfort of your very own home, any time that fits you. No demand to take time off job or traveling to a physical branch. With on the internet lendings, you have the ease and rate at your fingertips.

Flexible Repayment Options

As soon as approved for an online car loan, you can pick from a selection of adaptable settlement alternatives that match your financial circumstances. This is one of the significant benefits of online financings, as it permits you to customize your settlement plan based upon your specific requirements and preferences.

One option is to make fixed regular monthly settlements over a fixed time period. This can supply you with a predictable repayment timetable, making it less complicated to spending plan and also plan your financial resources. Another option is to make once a week or bi-weekly settlements, which can assist you settle your funding quicker and minimize passion fees.

If you choose extra adaptability, some on the internet lenders additionally use the choice to make minimum month-to-month repayments that consist of both principal and also rate of interest. This can be specifically advantageous if you have a variable income or if you expect changes in your monetary situation in the future.

Moreover, some online loan providers likewise supply the option to pay or make added payments off your finance early with no charges. This enables you to minimize interest fees and also potentially end up being debt-free faster.

On the whole, the accessibility of adaptable settlement options makes on the internet financings a personalized as well as hassle-free solution for customers. Whether you like a set settlement strategy or even more adaptability, you can locate a settlement option that suits your financial needs.

Access to Funds Anytime, Anywhere

If you require funds, accessing them anytime as well as anywhere is a vital advantage of on the internet loaning. With typical financings, you often have to go through a lengthy process of visiting financial institutions or lending institutions throughout details hours. With on-line over here finances, you can apply and accessibility funds whenever it's hassle-free for you. Whether it remains in the middle of the evening or throughout your lunch break, you have the versatility to get the cash you need without being restricted by time or place.

On the internet financing systems supply you with the convenience of accessing funds 24/7. All you need is a web link and a tool such as a computer system, smartphone, or tablet computer . Say goodbye to rushing to the financial institution before shutting time or waiting in long lines. You can simply log in to your online account, complete the necessary steps, and also get the funds transferred into your checking account within a brief period of time.

Not just does online loaning deal ease of access, yet it likewise permits you to manage your fundings on the move. Whether you're at house, at the workplace, or on vacation, you can conveniently monitor your finance status, make repayments, as well as examine your equilibrium through the online platform. This level of comfort and also flexibility makes online providing a recommended selection for many individuals seeking fast cash.

Competitive Rate Of Interest and also Terms

When contrasting various lending institutions, you'll locate that the interest prices and also terms offered by online lending platforms are typically competitive. On the internet loaning platforms have actually revolutionized the financing industry, Clicking Here providing customers with an alternative to conventional banks and lending institution. These systems take advantage of innovation as well as algorithms to streamline the lending procedure, causing reduced expenses prices and also eventually, a lot more competitive rate of interest and also terms for debtors like you.

One of the primary advantages of online lending systems is the capability to compare prices as well as terms from several lenders with just a few clicks. Rather of costs hours filling up or going to different banks out numerous applications, you can conveniently compare deals online and also look here pick the one that ideal fits your demands. This comfort not only conserves you time but additionally assists you make an informed choice.

Furthermore, on-line lending institutions typically have more lax qualification standards compared to conventional loan providers. They take right into account elements past just your credit history, such as your income as well as work background. This implies that also if you have less-than-perfect credit history, you still have a possibility to safeguard a funding with affordable rates and terms.

Final thought

So, currently you know the benefits of on-line loans. With a structured application procedure, fast authorization and funding, versatile payment alternatives, and also accessibility to funds anytime, anywhere, it's never been easier to get quick money within your reaches. And also, with affordable rate of interest and also terms, it's a convenient and cost effective method to satisfy your monetary requirements (Lamina short-term loans Montreal). Don't wait around for standard finances, go on the internet and also make use of these benefits today!

:max_bytes(150000):strip_icc()/callloanrate.asp-final-ea53db1a3c6041c0ab5f00fb30682a95.png)

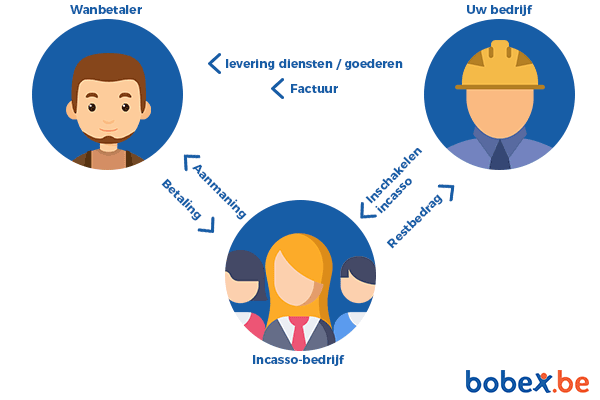

:max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg)